Past as Prologue

When considering the post-COVID-19 future of pharmaceutical sales, it’s helpful to look at the prevailing trends before the crisis hit. Well before the onset of COVID-19, more than half of U.S. physicians had already restricted access for pharma sales reps, according to ZS Associates’ AccessMonitorTM. Furthermore, even accessible doctors were spending less time with reps than in the past, with average visits dropping to under three minutes. As a result, the pharmaceutical field sales force, which peaked in size in 2005, had already been declining for the better part of two decades.

Enter COVID-19

The COVID-19 crisis is dramatically accelerating these trends. Face-to-face interactions with health care practitioners (HCPs) are no longer an option in most areas, and likely won’t be for the coming weeks or even months. As U.S. pharmaceutical company employees join the majority of the American workforce in working from home, sales reps are abruptly shifting to digital channels to engage with physicians. Virtual meetings, webinars, HCP portals, and emails are replacing in-office rep visits and dinner meetings. Additionally, all major medical conferences, normally a key forum for HCP interaction, have moved to a virtual format for the foreseeable future.

A March 2020 FirstWord pharma poll of physicians in the U.S. and EU sheds some light on HCP communication preferences in the near-term. Fewer than half of the polled physicians consider interacting with pharma reps through non-personal (virtual) channels while restrictions are in place to be a priority. In the absence of face-to-face meetings, most physicians prefer to be contacted via email (68%) and telephone calls (18%), with only 1 in 10 physicians preferring video calls. Given the many pressures that HCPs are facing right now – including steep declines in patient visits/revenue, disruption of supply chains, changes in treatment protocols, and the risk of becoming infected themselves – the deprioritization of pharma rep interactions, at least in the short term, is not surprising.

“While it’s still too early to say definitively, many industry analysts feel that the forced acceleration of digital adoption brought on by the pandemic is likely to have long-lasting impacts on the behavior of consumers and HCPs alike.”

The longer the restrictions on face-to-face meetings last, the more likely they are to become entrenched behavior. While it’s still too early to say definitively, many industry analysts feel that the forced acceleration of digital adoption brought on by the pandemic is likely to have long-lasting impacts on the behavior of consumers and HCPs alike, with many predicting that it is unlikely society will ever “go back” to pre-COVID-19 behavior. As HCPs become more accustomed to and comfortable with digital communications, and as pharma companies get better at communicating remotely, HCPs will likely continue to become even less reliant on face-to-face interaction.

The Path Forward

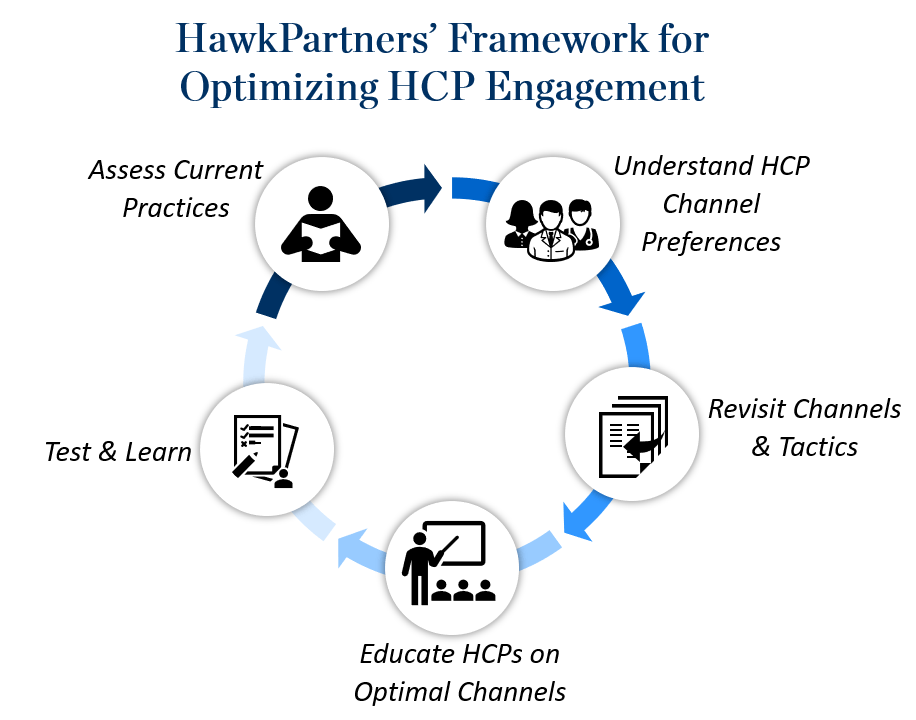

Moving forward, novel approaches will be needed to bridge the gap between current pharma industry sales practices and what will be practical and effective once the dust settles from COVID-19. HawkPartners has developed the following five-step framework to help pharma companies anticipate the “new normal” as a means of optimizing HCP engagement in a post-COVID-19 world.

1. Assess Current Practices

Start by taking an inventory of your brand’s HCP communications. Messages that could appear tone-deaf in the current environment may need to be revised. Next, assess your current, available channel mix and tactics to identify any gaps in HCP coverage. If needed, consider evaluating new technologies that offer integrated platforms for virtual engagement with HCPs.

2. Understand HCP Channel Preferences

Longer-term, it will be critical to understand target HCP channel preferences at the individual HCP level, if possible. If HCP-level preferences are not available, understanding preferences at the segment, specialty, practice, or geographic level will help inform a longer-term, customer-centric coverage model.

3. Revisit Channels & Tactics

Based on HCP channel preferences, available technologies, and internal resources, revise your mix of content and channels, with the goal of offering HCPs access to information where, when and how they want it. It will be critical to ensure visual sales aids are effective on relevant digital platforms – materials designed for in-person delivery may not be effective in digital channels, especially self-service ones. Careful consideration and potentially testing these materials with HCPs will help ensure they are optimized for the intended media. If needed, consider new messages and/or solutions aimed at addressing disruptions to practice and treatment protocols – including providing support/guidance on telemedicine, digitizing co-pay cards, and helping resolve supply chain issues.

4. Educate HCPs on Optimal Channels

HCPs will need and appreciate guidance on where and how to find information – the companies that make it easiest for them to do so will gain a competitive advantage. Self-service tools such as HCP portals and interactive voice details may require education/training to establish HCP comfort with the technology. Messaging should focus not only on where and how to get information, but also why it is important. Providing concrete benefits including the ability to save HCPs time, or access to newer/better information, will help drive adoption.

5. Test & Learn

At this point, consider piloting new digital engagement platforms and tools. Digital engagement tools offer the potential for greater customization (at the segment level) and potentially personalization (at the individual HCP level) based on content and channel preferences, importance to the brand, and other factors. As new tools are implemented, use a consistent set of metrics for evaluating different channels to ensure a data-driven approach to determining which methods should be expanded and which should be discontinued.

Conclusion

At some point in the (hopefully) near future, there will be some semblance of a “return to normal.” While we feel that there will be a continued role for in-person rep meetings, dinners, and conferences in the new pharma sales model, the COVID-19 crisis has likely accelerated the industry trajectory toward fewer in-person HCP meetings and the need to adapt using alternative methods. Digital channels will play a prominent role as HCP adoption and comfort levels accelerate.

The coming months will shed light on which pharmaceutical companies can quickly adapt their sales models as the future landscape comes more clearly into focus. Those companies that can do so quickly and effectively will be well-positioned for success when the new normal eventually emerges.

HawkPartners can help pharma companies as they navigate this path to the new normal, whether it be understanding HCP channel preferences, assessing the ROI of new channels or tactics, optimizing messages, refining sales aids, or other related areas.